All Categories

Featured

Table of Contents

- – Elite Accredited Investor Wealth-building Oppo...

- – World-Class Accredited Investor Investment Ret...

- – All-In-One Exclusive Investment Platforms For...

- – Accredited Investor Investment Opportunities

- – Innovative Top Investment Platforms For Accr...

- – Passive Income For Accredited Investors

- – Turnkey Accredited Investor Syndication Deal...

The regulations for recognized financiers differ among territories. In the U.S, the interpretation of an accredited financier is presented by the SEC in Policy 501 of Policy D. To be an accredited financier, a person needs to have an annual income surpassing $200,000 ($300,000 for joint income) for the last 2 years with the expectation of making the very same or a higher income in the present year.

This amount can not include a primary home., executive policemans, or supervisors of a firm that is providing non listed safety and securities.

Elite Accredited Investor Wealth-building Opportunities

Also, if an entity contains equity owners that are certified investors, the entity itself is a certified investor. A company can not be formed with the sole purpose of buying certain securities. An individual can qualify as an approved investor by showing adequate education or task experience in the monetary sector

Individuals that wish to be certified investors don't use to the SEC for the classification. Rather, it is the responsibility of the company offering a personal positioning to see to it that all of those come close to are certified investors. Individuals or celebrations who desire to be certified financiers can come close to the company of the non listed securities.

For instance, suppose there is a specific whose income was $150,000 for the last three years. They reported a key house worth of $1 million (with a mortgage of $200,000), a car worth $100,000 (with a superior financing of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

This individual's internet well worth is precisely $1 million. Because they fulfill the web worth requirement, they qualify to be an accredited financier.

World-Class Accredited Investor Investment Returns

There are a couple of much less usual qualifications, such as taking care of a trust with more than $5 million in properties. Under government safety and securities legislations, only those that are approved capitalists might take part in particular safeties offerings. These may consist of shares in personal placements, structured products, and personal equity or hedge funds, amongst others.

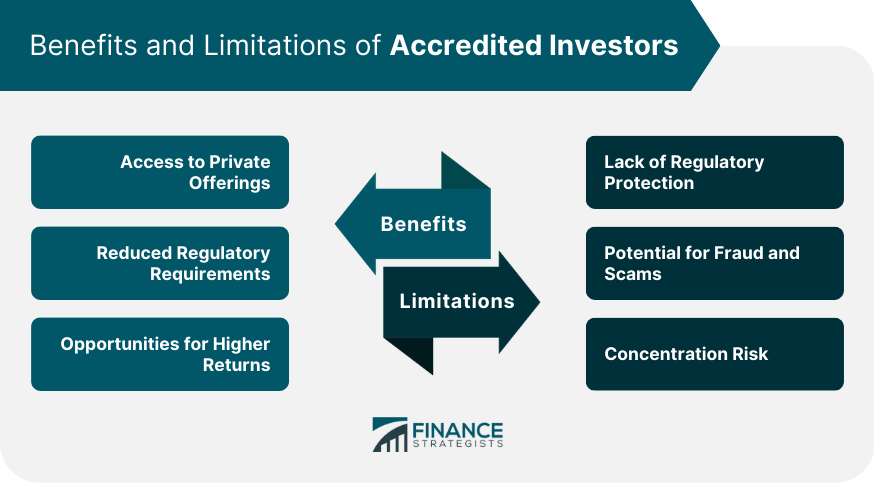

The regulatory authorities want to be particular that participants in these extremely risky and intricate investments can fend for themselves and judge the dangers in the lack of federal government defense. The certified investor policies are made to protect possible financiers with limited economic understanding from dangerous ventures and losses they may be ill outfitted to hold up against.

Certified capitalists meet certifications and specialist standards to gain access to special investment opportunities. Approved capitalists have to meet earnings and net worth requirements, unlike non-accredited individuals, and can invest without restrictions.

All-In-One Exclusive Investment Platforms For Accredited Investors

Some crucial changes made in 2020 by the SEC include:. This change acknowledges that these entity types are typically utilized for making financial investments.

This adjustment make up the impacts of inflation in time. These amendments broaden the accredited financier swimming pool by about 64 million Americans. This broader access provides much more possibilities for financiers, yet additionally raises potential risks as much less economically advanced, investors can participate. Companies utilizing personal offerings may profit from a larger pool of potential financiers.

One major advantage is the possibility to purchase placements and hedge funds. These financial investment choices are special to accredited capitalists and establishments that qualify as a certified, per SEC laws. Personal placements allow companies to secure funds without browsing the IPO treatment and regulatory documentation required for offerings. This offers recognized investors the possibility to buy arising companies at a phase before they think about going public.

Accredited Investor Investment Opportunities

They are watched as financial investments and are available just, to qualified clients. In enhancement to well-known companies, certified financiers can pick to spend in start-ups and up-and-coming endeavors. This offers them tax obligation returns and the opportunity to enter at an earlier phase and potentially reap benefits if the company prospers.

For capitalists open to the threats included, backing start-ups can lead to gains (accredited investor opportunities). A number of today's tech business such as Facebook, Uber and Airbnb stemmed as early-stage startups sustained by approved angel financiers. Advanced capitalists have the possibility to explore financial investment choices that may produce a lot more revenues than what public markets offer

Innovative Top Investment Platforms For Accredited Investors

Returns are not assured, diversification and portfolio enhancement choices are expanded for investors. By expanding their portfolios through these increased investment methods approved financiers can improve their approaches and possibly achieve premium long-lasting returns with correct danger administration. Seasoned financiers often encounter investment alternatives that may not be easily offered to the basic financier.

Investment alternatives and securities provided to approved financiers normally include greater risks. As an example, personal equity, financial backing and hedge funds frequently focus on buying assets that lug threat however can be sold off conveniently for the opportunity of higher returns on those high-risk financial investments. Investigating before investing is crucial these in circumstances.

Lock up periods protect against investors from withdrawing funds for more months and years on end. There is additionally far less transparency and governing oversight of private funds contrasted to public markets. Capitalists might have a hard time to properly value private possessions. When taking care of threats recognized investors need to analyze any private investments and the fund supervisors entailed.

Passive Income For Accredited Investors

This modification might extend certified investor standing to a range of people. Permitting partners in dedicated relationships to integrate their sources for common qualification as recognized capitalists.

Allowing individuals with specific professional certifications, such as Series 7 or CFA, to qualify as certified investors. This would certainly acknowledge economic class. Developing added requirements such as evidence of financial literacy or efficiently finishing an accredited capitalist exam. This could guarantee financiers understand the risks. Restricting or eliminating the main residence from the total assets computation to reduce potentially filled with air evaluations of riches.

On the various other hand, it could also result in skilled capitalists thinking excessive threats that may not be appropriate for them. Existing recognized financiers might encounter increased competitors for the finest investment opportunities if the swimming pool expands.

Turnkey Accredited Investor Syndication Deals for Accredited Investor Deals

Those who are currently thought about accredited capitalists must remain upgraded on any changes to the standards and regulations. Companies looking for accredited investors should stay alert concerning these updates to ensure they are bring in the appropriate audience of financiers.

Table of Contents

- – Elite Accredited Investor Wealth-building Oppo...

- – World-Class Accredited Investor Investment Ret...

- – All-In-One Exclusive Investment Platforms For...

- – Accredited Investor Investment Opportunities

- – Innovative Top Investment Platforms For Accr...

- – Passive Income For Accredited Investors

- – Turnkey Accredited Investor Syndication Deal...

Latest Posts

Next-Level Tax Sale Overage List Strategy Tax Overages Business

Advanced Foreclosure Overages Strategy Tax Overages List

Tax Foreclosure Overages

More

Latest Posts

Next-Level Tax Sale Overage List Strategy Tax Overages Business

Advanced Foreclosure Overages Strategy Tax Overages List

Tax Foreclosure Overages